There’s no denying the Sunshine Coast is experiencing a huge growth spurt which some analysts have described as unprecedented and unlike anything in Australian history.

We are bracing for the highest interstate migration of anywhere in Australia, property prices are soaring like never before and land is being snapped up as the two major estates – Aura and Harmony – expect to be completed years ahead of schedule.

But with every so-called ‘boom’ comes a doomsday prediction of a bust and there are residents already wondering if the current frenzy will be sustainable.

To answer this question, Sunshine Coast News approached five experts and asked them: ‘Will there be a bust on the Sunshine Coast?’

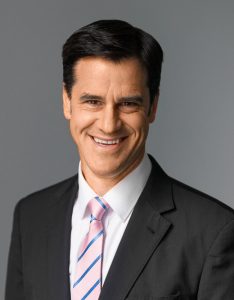

Andrew Garland, Ray White Caloundra principal

Andrew Garland said no-one foresaw the way in which the market would explode during COVID, but now that it was happening, he was not expecting it to deflate.

This is because the reasons so many people to want to move to the Sunshine Coast and buy properties would continue.

Mr Garland said that in the 2007 ‘boom’, it was investors leading the charge that caused the market to inflate, but this time the demand was being driven by owner-occupiers.

“(For a bust to happen) all the owner-occupiers would have to suddenly not want to be here anymore and walk away and place all their properties on the market which is not going to happen,” said Mr Garland.

In reality, people were moving to the Coast because they wanted the lifestyle and they were unlikely to give up that dream.

Mr Garland said a more likely scenario would be a softening of the urgency which had been pervading the last few months, and that was already starting to happen.

“I believe the steam has come out — it’s just busy now, not frenetic,” he said.

Help keep independent and fair Sunshine Coast news coming by subscribing to our free daily news feed. All it requires is your name and email. See SUBSCRIBE at the top of this article

“Buyer enquiries have reduced but that doesn’t meant buyers have gone. It just means the craziness has past.”

Mr Garland said many buyers would have been priced out of the market during the recent over-heating and had stopped looking which would be contributing to the cooling off.

But he was not anticipating a fall in the market that could be classified as a bust.

“I don’t see any bust, not at all. There has been a softening of demand, not in a negative sense but it’s just more sustainable, but it’s not going to go away.

“People want to come here and that’s not going to change.”

Terry Ryder, Hotspotting property analyst

Terry Ryder says the transformation of the Sunshine Coast’s economy from its past reliance on tourism to one with more diversity and strength will continue to attract more newcomers.

The market would continue to be driven up because of increasing demand for property, attractive lifestyle, more affordable living and low mortgage rates.

“Nothing has changed that would create a slowdown,” said Mr Ryder. “The trends that have been driving us to this point are very much in evidence.”

Investors are also returning, with the ABS recently reporting the value of national new investor lending rose by 12.7 per cent over March 2021 to $7.8 billion, a rise of 54.3 per cent through the year.

“To date, with most markets around Australia, it’s been very much driven by owner-occupier, first home buyers,” Mr Ryder said.

“Investors are coming back into the market which will give further impetus to price rises by creating more competition.

“The Coast has a future well beyond what is currently happening and will continue to be a strong regional economy and a strong property market as a result.”

Mark McCrindle, social researcher

When Sydney was going through a growth spurt 30 years ago, people wondered whether the city of 3.5 million people could cope with getting any larger, says Mark McCrindle.

But today the NSW capital has about 5 million residents and has been able to “adjust” to accommodate the 1.5 million extra newcomers.

Although the Sunshine Coast had not even reached half a million residents, let alone a million, Mr McCrindle said the experiences of other booming cities indicated the Sunshine Coast had “room to grow”.

“There will be more sprawl but also more densification,” he said.

Do you have an opinion to share? Submit a Letter to the Editor with your name and suburb at Sunshine Coast News via: news@sunshinecoastnews.com.au

Mr McCrindle identified three solid factors which he said would ensure the current growth was sustainable and would not “bust”.

These include:

- Affordability: For people living in expensive capital cities down south, the Sunshine Coast is not only beautiful but it’s affordable — even as local prices continue to increase. This comparative affordability means the Sunshine Coast will continue to be desirable. “Regional cities are always going to be more affordable than the capitals,” says Mr McCrindle.

- Lifestyle: the pandemic forced people to take stock of their lives and seek more balance and part of that involved re-assessing where they were living. Many escaped to regional communities like the Sunshine Coast. But in this migration wave it’s not just retirees wanting somewhere to spend their twilight years, but couples and families searching for a better lifestyle.

- Employment: Working from home has changed the employment dynamic and given people the flexibility to live wherever they want — so why not move to the Sunshine Coast? “Even if we do go back to more time in the office, they can commute to the Brisbane CBD a couple of days a week,” he said.

Direct Collective, property market update 2021

Direct Collective’s latest market research report tackles the question: Will there be a bust following the boom?

“It’s a common thought, opinion and question. The challenge is, the proposition is wrong. Booms are driven by speculative behaviour combined with access to easy money,” states the report.

“Currently the levels of investment lending is not only almost half that of ‘boom times’, it’s currently around one third below normal levels.

“The current activity is not driven by investors, that will come, but for now it’s driven by home owners and it’s something the government is and will continue to encourage through assistance such as the recent Home Builders’ Grant.”

Over the next 12 to 24 months, owner occupier activity alone is expected to keep growing, before investment activity returns to normal levels and long before reaching ‘speculation’ levels.

“What is happening on the Sunshine Coast is so unique and profound, there isn’t anyone qualified to make the ‘boom/bust’ call in the short term.”

Antonia Mercorella, CEO of REIQ

Antonia Mercorella does not believe the Sunshine Coast will experience a bust, in fact, she doesn’t even describe the current growth phase as a boom.

Ms Mercorella said high demand for properties on the Coast and in Queensland was more like a “burst of activity” which would eventually settle.

But she did not expect the market to burst because the current factors driving the change were not the same as the investor-driven scenarios of a typical boom-bust cycle.

“I don’t think we’re in a boom,” she said. “When you think of a boom, you think of speculative buyers.”

Ms Mercorella said the Sunshine Coast was going through an “accelerated” growth period as it played catch up with interstate markets which were more expensive.

And the factors underlining that growth were not about to go away.

These included low interest rates which were set to remain for years to come, the affordability of Queensland compared to NSW and Victoria and a confidence in the market.

Ms Mercorella was recently at a Sunshine Coast function attended by 140 local real estate agents and said the vibe in the room was still optimistic about an ongoing sustained demand for property.

“In Queensland we have great affordability (compared to interstate). Even before COVID it was the number one destination of interstate migration,” she said.

“What we have been seeing is accelerated growth and there has been a sense of urgency in some areas.

“Agents say the sense of urgency is driven by limited stock but we’re starting to see more stock become available and we should start to see that urgency slow.

“The burst of activity with people moving here during COVID had accelerated that and created a new level of demand and because stock was limited people had to move quickly and helped property prices go up at a faster level but that urgency will slow.

“As demand eases up a bit, after that it will become more steady and return to an even keel rather than going up at the pace we’ve been seeing.”

-with Tracey Johnstone