Property values have dived dramatically on the Sunshine Coast and beyond, bringing an apparent end to a two-year boom.

The latest insight from property experts CoreLogic show house prices in the region experienced a 4.5 per cent decline since the market peaked a few months ago, and a 2.2 per cent fall from July to August.

That’s the third largest drop across regional areas in Australia, behind Richmond-Tweed and Southern Highlands-Shoalhaven in New South Wales, and the second biggest drop in Queensland, behind Brisbane North.

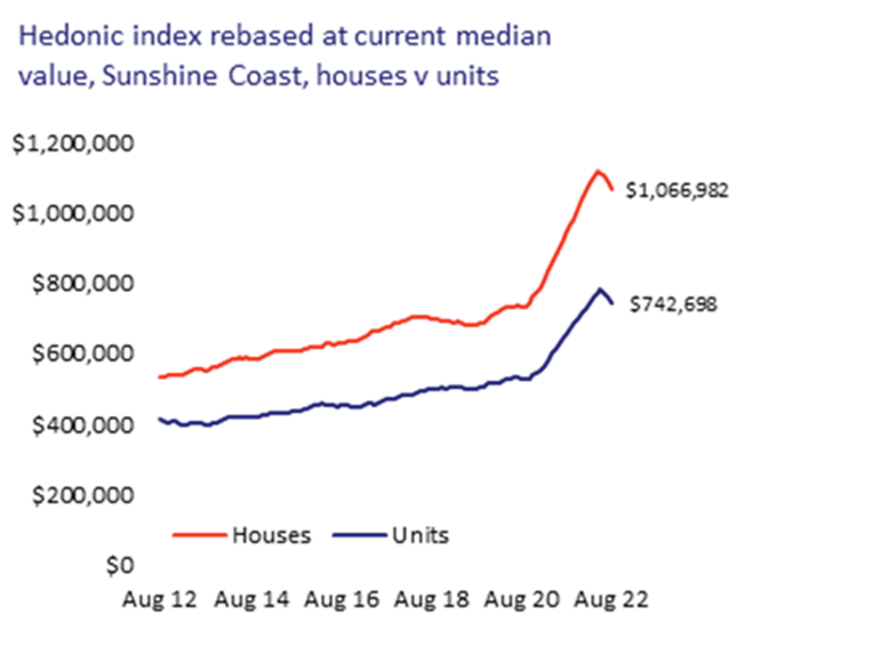

Houses that were worth a median price of almost $1.117m in April have lost significant value to sit at $1.066m in August, which is about $50,000 less.

Unit prices in the region experienced a 5.5 per cent decline. Units worth a median price of $785,000 in May were worth about $742,000 in August.

The sudden drop in prices was a stark contrast to the phenomenal price rises from early 2020 to April/May this year.

Housing values in the region rose by a whopping 52.5 per cent from the COVID trough to the recent peak in values, with a median gain of about $337,000.

But interest rate hikes, implemented in stages from May, appear to be making an impact as prospective buyers show more restraint.

CoreLogic’s research director Tim Lawless expected prices could continue to tumble for a while.

“We’re now into the down phase,” he told Sunshine Coast News.

“The market peaked in April to May and we’ve seen three to four months of value falls now and it looks like that’s gathering some momentum,” he said.

“It will probably continue trending downwards for more than a few months, but it is really dependant on the trajectory of interest rates.

“We’re expecting interest rates probably won’t find a peak until late this year or coming into next year, but that’s highly uncertain.

“When we start to see interest rates stabilise that will probably be the queue for housing prices to stabilise.”

He said owners could still make incredible profits.

“The market has turned but for most people who own a property they will still find themselves in quite an extraordinary equity position considering that run-up in value (during the past two years), unless they bought into the marketplace recently.”

He said the recent sharp drop in prices was a relative reaction to the steep increase in prices.

“Prices are falling so much on the Sunshine Coast because of the magnitude of the upswing,” he said.

“We probably saw the marketplace overshoot the mark there.

“A 50-odd percent growth rate over the past couple of years has been unsustainable.

“We have also seen this in similar areas like Byron, the Southern Highlands and the Gold Coast. They also had spectacular run-ups in values and are now falling at a similar rate.”

He said the Sunshine Coast had a bigger boom than most places because of its coastal charm.

“Through the pandemic, we saw a real transition and demand to lifestyle markets,” he said.

“The Sunny Coast ticks that box, so it was in the sweet spot for demand.

“We saw interstate migration rocket into South-East Queensland, driving the demand.

“More people have been able to work remotely, so we’ve seen people move there.

“Early in the growth phase (2020/2021), there was a real affordability advantage on the Sunshine Coast, especially for interstate migrants coming out of markets like Sydney and Melbourne, who could cash out of those (lucrative) markets and buy into the Sunny Coast.

“That advantage has been largely eroded now because we’ve seen house prices rise.”

Prices remain high for high-quality homes

Local McGrath real estate sales agent, Matt Diesel, said prices in the region had cooled.

Mr Diesel is the Chairman for the Sunshine Coast zone of Queensland’s peak body for the real estate industry, the Real Estate Institute of Queensland.

He said the market was levelling out and that it would create a “healthy” environment for buyers and sellers.

“We’ve just gone back to a normal market,” he said.

“It’s gone from manic to manageable.”

Mr Diesel said the prices for average homes were decreasing more.

“The stock that is correcting in price is the B and C-grade stock,” he said.

“That stock is now sitting there and if it’s not of the perceived value, then that will show up.

“Buyers are taking their time a bit more. They’re looking at the stock and understanding what it is and the value in the area.

“People were paying overs on just about everything and they weren’t taking the time to think about it.

“They were putting in offers site unseen and waiving cooling-off periods and not doing their due diligence with that B and C-grade stock.”

But Mr Diesel said there was still strong competition for high quality property.

“The blue-riband stuff, the A-grade stock, is still performing well,” he said.

“It’s still selling and they’re getting record prices, as we’ve seen in the past couple of weeks. There have been some phenomenal sales and competition for them.

“It just depends on where it is and what it is.”

He expected the price falls to settle in the near future.

“We’ve gone back to a nice, steady level and I think it will even out now for the next couple of years, until we get our next rise.”

“I think we’re just about at the bottom of where it’s going to correct to.

“After a massive rise, there was always going to be a settling out period and we’re just going through that and now we are going into an even and normal market for a while.”

Help keep independent and fair Sunshine Coast news coming by subscribing to our free daily news feed. All it requires is your name and email. See SUBSCRIBE at the top of this article.

Mr Diesel said some new real estate agents were “panicking” because of the price falls.

“Some who haven’t been through it (a downward trend) are panicking and the media is not doing any favours.

“But a lot of agents also understand where we are at, going back to a normalised market.

“Interest rates are still crazy low and if there wasn’t all this hype in the media, I think the rate (of the decline) would be slower.

“People aren’t prepared to pay ridiculous prices for B and C-grade stock, like they did but there are still plenty of buyers, and buyers looking for good quality stock, and they will pay for that.”

He also said the steep price falls on the Sunshine Coast were a flow-on effect from the dramatic price rise.

Housing lending down as prices fall

The value of nation-wide lending for housing dropped sharply in July as property prices fell around Australia.

The Australian Bureau of Statistics said new loan commitments for housing in Australia in July dropped 8.5 per cent on the previous month.

Meanwhile, home values saw the sharpest monthly drop in almost four decades in August.

The national index fell 1.6 per cent over the month.

The decline has spread to every capital city except Darwin, with Sydney still leading the downward course – falling 2.3 per cent over the month.

Brisbane’s downturn is also gathering pace, with values falling by 1.8 per cent following a 0.8 per cent drop in July.

In August, regional home values fell 1.5 per cent.

But dwelling values remained well above pre-COVID levels despite the softening market, with all regions and capitals except Melbourne still seeing home values at 15 per cent or above the levels recorded in March, 2020.

-Additional reporting by AAP.