Hinterland property prices are booming as the Sunshine Coast undergoes a real estate revival.

A host of inland localities were among the nation’s top growth suburbs from June to August.

Mapleton, Glenview, Mooloolah Valley, Palmview and Witta were just some of the hot spots, according to property experts CoreLogic.

The former’s median value jumped 8.9 per cent to $904,653.

CoreLogic executive research director Tim Lawless believed prospective buyers were lining up for hinterland real estate, which is cheaper than on the coast, but there wasn’t enough to go around, which pushed up prices.

“This area is showing extremely low levels of advertised supply, with listings 17 per cent lower than at the same time a year ago and 40 per cent below the decade average,” he said.

“The strength in the market looks to be a case of demand outweighing supply.”

The suburbs leading the hinterland property boom are:

- Mapleton: fourth strongest growth location in Australia, median value $905,000, three-month increase of 8.9 per cent;

- Glenview: 12th, $1.205m, 8.1 per cent;

- Mooloolah Valley: 17th, $1m, 7.3 per cent;

- Palmview: 18th, $837,000, 7.1 per cent;

- Witta: 20th, $1.02m, 6.9 per cent;

- Glass House Mountains: 22nd, $895,000, 6.7 per cent;

- Rosemount: 27th, $1.17m, 6.5 per cent;

- Montville: 45th, $962,000, 5.6 per cent; and

- Forest Glen: 69th, $966,000, 5.1 per cent.

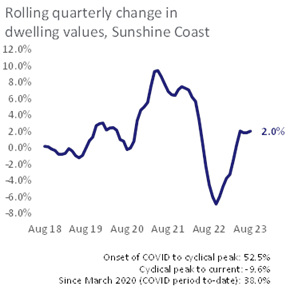

Property prices on the Sunshine Coast, in general, have experienced an upward swing.

The region was ranked sixth, among 108 in Australia, for value growth during the past three months, with a gain of 1.6 per cent.

“The region has been recording a consistent rise in values over the past six months, since bottoming out in February,” Mr Lawless said.

“Sunshine Coast housing values are up 4.1 per cent since finding a floor but remain 9.6 per cent below the record high set in May last year.”

Related story: Why Coast property prices have turned around

Mr Lawless said the region’s recent property surge was also due to high demand, fuelled by newcomers to the region, outstripping supply.

“Advertised supply levels remain very tight across the Sunshine Coast region, trending lower through the year to date to be 40 per cent below the decade average,” he said.

“At the same time, demand from internal migration remains strong, with the Regional Australia Institute noting the Sunshine Coast receives the largest share of net internal migration of any region nationally.”

Mr Lawless was unsure if hinterland property prices would continue to rise at the same pace in coming months.

“It’s unlikely growth rates will remain this high for long, simply due to affordability constraints becoming more pronounced and demand deflecting to more affordable areas of the Coast,” he said.

“However, if advertised supply levels remain low relative to demand, it’s likely values are set to rise further from here.”

Mr Lawless expected property growth to increase slowly in the broader region.

“The growth trend looks entrenched across the Sunshine Coast but is no longer accelerating like we were seeing earlier in the recovery,” he said.

“Considering available supply generally remains low across the Coast and demand seems to be outweighing supply, it’s likely we will continue to see prices rising.

“The trend in listings will be a key factor to watch through spring and early summer.

“This is when listings activity is normally seasonally strong.

“We could see at least a partial rebalancing between supply and demand if listings rise substantially from their current levels.”

The Reserve Bank of Australia on Tuesday announced that interest rates would hold at 4.1 per cent, for the third month in a row, in welcome news for borrowers.