The Sunshine Coast could be part an exclusive real estate corridor in 2025, according to a leading property expert.

The region has experienced remarkable growth, with median house values soaring 76 per cent to $1.14 million during the past five years.

Price rises are expected to slow somewhat this year but Ray White senior data analyst Atom Go Tian said the Sunshine Coast would still be a property powerhouse, as part of an elite triad.

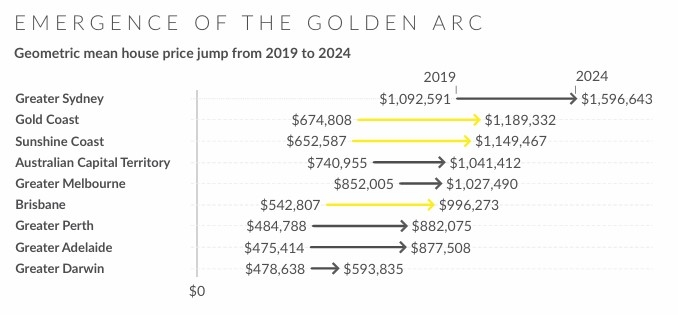

“The Australian housing market is witnessing a fundamental restructuring, characterised by the emergence of distinct price bands and the formation of what could be termed the ‘Golden Arc’,” he said.

“The Golden Arc is likely to emerge with Brisbane joining the Gold Coast and Sunshine Coast as premium markets.

“The Gold Coast and Sunshine Coast have established themselves as Australia’s second and third most expensive housing markets (behind Sydney).”

“Notably, the Gold Coast overtook Melbourne in 2022, followed by the Sunshine Coast surpassing Melbourne in 2023.

“Brisbane is also showing signs of joining its coastal counterparts. The city has the second-highest five-year growth rate, trailing only Adelaide.”

Mr Go Tian explained why the Sunshine Coast property market was so strong.

“The performance likely reflects several factors including continued interstate migration to Queensland’s lifestyle regions, limited housing supply in a geographically constrained coastal market, relative affordability compared to Sydney while offering similar lifestyle benefits, and strong local economy and infrastructure development,” he said.

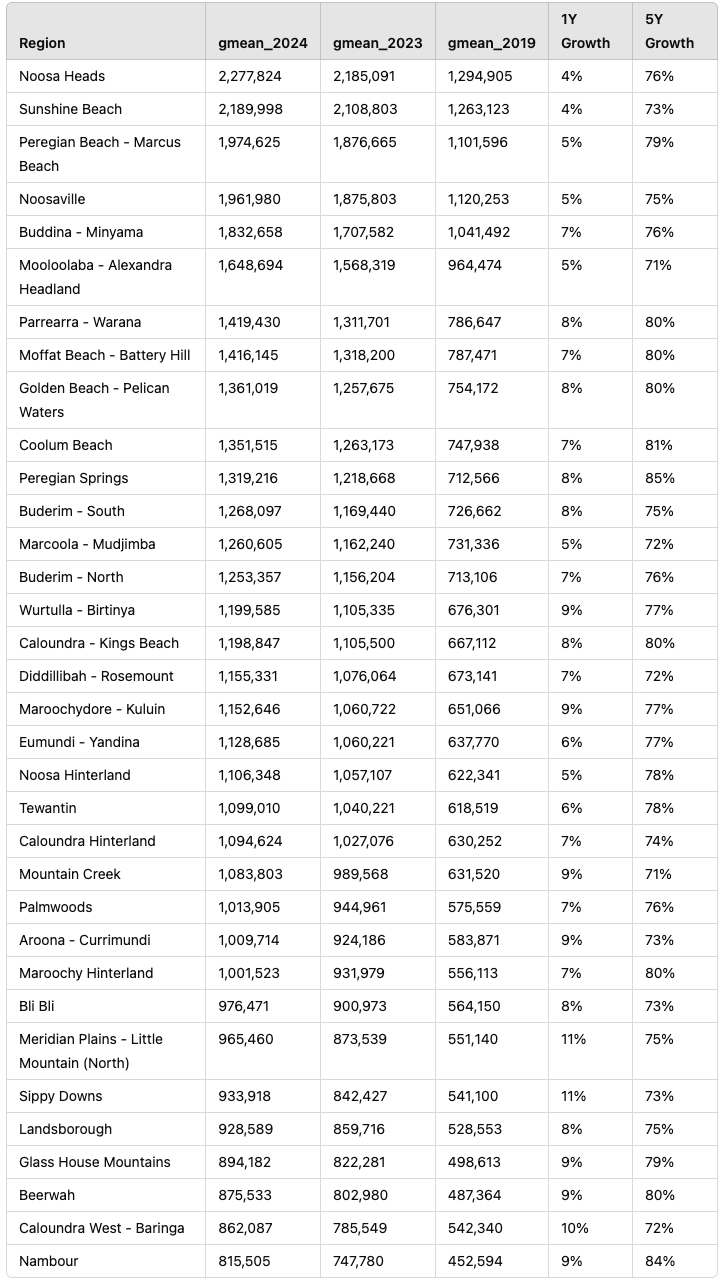

Ray White data showed the strongest growth areas on the Sunshine Coast last year included: Meridan Plains-Little Mountain north (11 per cent); Sippy Downs (10 per cent); Caloundra West-Baringa (10 per cent; Mountain Creek) 9 percent; Aroona-Currimundi (9 per cent); and Beerwah (9 per cent).

“Common factors driving growth in these areas were the more affordable entry points,” Mr Go Tian said. “Most were under the $1 million median … and infrastructure development and accessibility, family-friendly amenities and schools, new housing developments meet market demand.”

Slower growth areas included Noosa Heads (4 per cent); Sunshine Beach (4 per cent); Peregian Beach-Marcus Beach (5 per cent); and Mooloolaba-Alexandra Headland (5 per cent).

“These premium markets showed slower growth likely due to already-high price points above $1.6 million, market resistance to further price growth, and interest rate impacts on luxury market segments,” Mr Go Tian said.

Homes in many Sunshine Coast towns and suburbs are now worth more than $1 million.

“Regional Australia’s million-dollar club has undergone a dramatic expansion, growing from just two areas five years ago to encompass 20 locations today,” Mr Go Tian said.

“The concentration of $1 million areas in Queensland’s coastal regions is unsurprising, with the Gold Coast and Sunshine Coast collectively accounting for 14 of the 20 million-dollar areas.”

The Sunshine Coast hinterland and Nambour are tipped to be among the next five locations in regional Australia to breach the mark.

Price ‘slowdown’ expected

CoreLogic executive research director Tim Lawless said a “levelling out in the market” could be expected in 2025.

He said Sunshine Coast property prices had increased by about 6.7 per cent last year but there was a noticeable “slowdown”.

“Growth in home values has clearly peaked,” he said.

“The trends are pointing towards a levelling out in the market, with value growth losing steam since April.”

He detailed one of the reasons why.

“Housing affordability is approaching new record highs across the Sunshine Coast, with the dwelling value to household income ratio reaching 11.5 in September.”

“This means a household on the median income would be spending 11.5 times their annual gross income to purchase the median priced dwelling on the Sunshine Coast.

“With affordability this stretched it simply becomes harder for buyers to enter the market and demonstrate an ability to service their mortgage.”

Mr Lawless said interstate migration had also waned.

But he still expected the region to boast relatively high property prices.

“It’s unlikely we will see any material fall in Sunshine Coast home values next year, given low levels of newly built supply and persistently low advertised supply as well,” he said.

“Even as population growth slows, interstate migration looks to be holding above average which is likely to provide some support for housing demand.

“(And) over the longer term, the large amount of infrastructure investment underway across the South-East Queensland should help to support demand and improve liveability across the region.”

Mr Lawless said it was still a sellers’ market but properties were staying on the market for longer.

“With listings holding quite low relative to historic levels, buyers still don’t have a great deal of choice in the market and arguably vendors still have the upper hand,” he said.

“But we are seeing the median number of days it takes to sell gradually rise (32 days).”

He said there was significant interest in units from buyers.

“The local unit market recorded a slightly stronger growth rate than houses, up 7.3 percent in value over the past 12 months,” he said.

“The trend towards a larger rise in unit values over houses has been evident across most of the capital cities as well, including Brisbane, and can probably be attributed to affordability constraints becoming more prolific across the market, deflecting more demand towards the lower priced unit sector.”

REA Group figures showed that apartments at Coolum Beach, Warana, Sippy Downs and Twin Waters all had price increases of more than 14 percent in 2024.

Interest in interest rates

Mr Lawless said that interest rates “will influence the market” in 2025.

The cash rate has been at 4.35 per cent since November, 2023, but is expected to dip this year.

“As interest rates come down, expect to see a further boost to confidence and a rise in borrowing capacity,” he said.

“Watch for stronger growth conditions across the more affordable suburbs of the Coast that might be more responsive to lower interest rates when they finally start to come down.”

REA Group senior economist Anne Flaherty also said interest rates would be telling.

“Home price growth is expected to continue in the Sunshine Coast over 2025, though the rate of growth is likely to be determined by interest rate settings,” she said.

“Over the past six months, price growth has slowed on the Sunshine Coast.

“This trend is expected to continue into 2025 however a reduction in interest rates could reverse this trend.”

Luxury properties and baby boomers

Director of Ray White Maroochydore and Buderim Dan Sowden expected the 2025 property market to be “much the same” as 2024.

“In certain pockets there will be continued growth, but in other areas there will be opportunities for buyers,” he said.

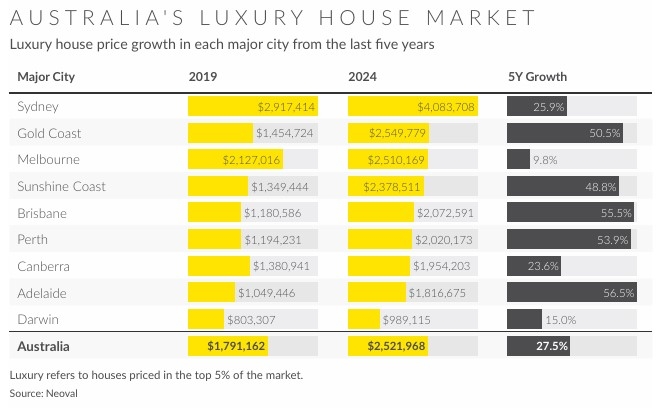

He believed luxury properties would continue to attract top dollar.

“I think that market will perform very well,” he said.

“It’s dominated by the baby boomer demographic buyers.”

“There are lots of buyers with the capacity to purchase at strong prices.”

The Sunshine Coast has experienced considerable growth in luxury real estate, with a 49 per cent price increase during the past five years.

Prices jumped from $1.34 million to $2.37 million.

Meanwhile Mr Sowden said there would be opportunity for buyers in “typical family suburbs”, where he said more homes were coming on to the market.

“There are more choices there … but buyers in these areas are budget sensitive so interest rates and cost of living will play a role,” he said.